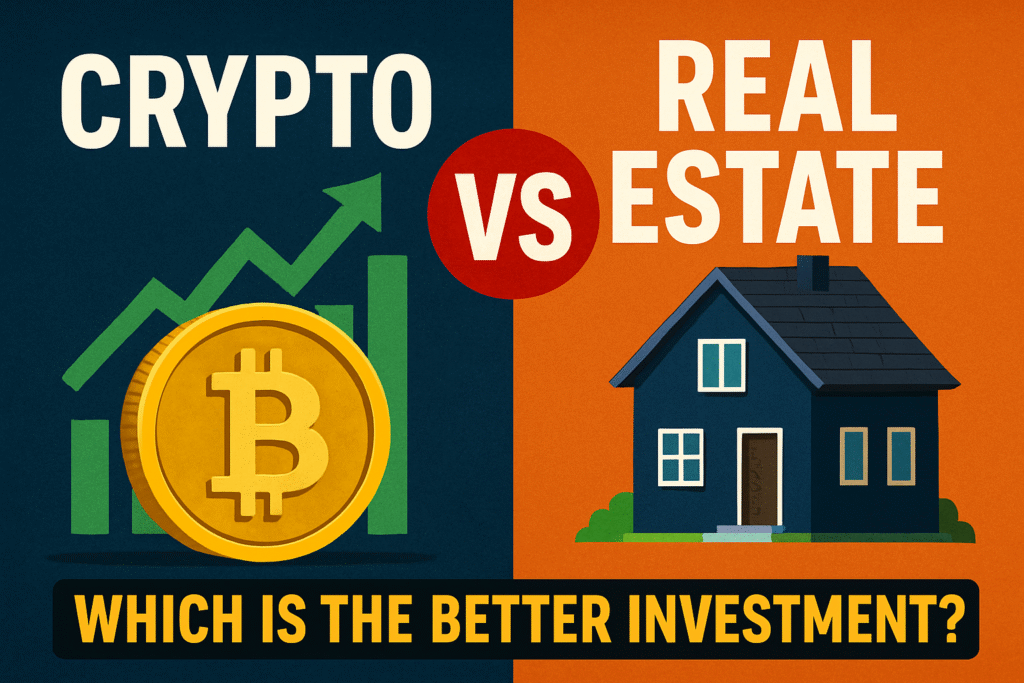

Real Estate vs. Cryptocurrency

Investors are facing a tough decision between these two trending asset classes. Real estate offers stability, long-term growth, and passive income through rental yields. It’s a tangible asset that has stood the test of time, especially during economic uncertainty.

On the other hand, cryptocurrency offers high-risk, high-reward potential. With rapid price movements and global market access, crypto attracts those looking for faster returns. However, volatility and regulation issues make it less predictable than traditional investments like property.

When comparing Real Estate vs Crypto: Which is the Best Investment, the answer depends on your financial goals, risk tolerance, and time horizon. Real estate is ideal for long-term wealth building, while crypto may suit short-term gains and tech-savvy investors. Diversifying across both can also be a smart strategy.

What is Real Estate Investment?

Real estate investment involves buying, owning, managing, or selling physical properties to build wealth. This can include residential homes, apartments, commercial buildings, retail spaces, or undeveloped land. Unlike digital assets like stocks or cryptocurrencies, real estate is a tangible investment with intrinsic value. Over the years, it has shown stable growth and consistent appreciation, making it a trusted and long-term option for generating reliable returns.

Why Invest in Real Estate?

Real estate comes with several key advantages that make it a go-to investment for many.

Consistent Appreciation: Property values generally rise over time, helping investors grow their wealth steadily.

Passive Income Potential: Rental properties generate regular income, offering a reliable cash flow stream.

Growing Demand: With increasing urbanization and population growth, the need for housing and commercial space remains strong.

Attractive Tax Benefits: Investors can benefit from deductions on mortgage interest, property depreciation, and other expenses.

Lower Volatility: Unlike high-risk assets like crypto, real estate tends to be more stable and less affected by market swings.

What is Cryptocurrency Investment?

Cryptocurrency is a digital form of money secured through cryptography and powered by decentralized blockchain technology. Unlike traditional currencies managed by central banks, cryptocurrencies operate on peer-to-peer networks, enabling secure and transparent transactions without intermediaries. Popular cryptocurrencies like Bitcoin, Ethereum, and others can be bought, sold, or traded on digital exchanges, with every transaction permanently recorded on a tamper-proof digital ledger.

Pros of Cryptocurrency Investment

- High Returns: Cryptocurrencies have shown the potential for exponential growth, delivering significant returns in a short time.

- Global Accessibility: Cryptocurrencies transcend geographical boundaries, enabling seamless transactions worldwide.

- Liquidity: Digital assets can be quickly traded or converted to fiat currency, offering flexibility to investors.

Cons of Cryptocurrency Investment

Cryptocurrency comes with its own set of challenges that investors must carefully consider:

High Market Volatility: Crypto prices are extremely sensitive to market sentiment, global news, and investor speculation—leading to sharp price fluctuations and potential losses.

Regulatory Uncertainty: With governments tightening rules around digital assets, the future of cryptocurrency remains uncertain and subject to change.

No Physical Asset: Unlike real estate, cryptocurrencies are intangible and lack intrinsic value, making them harder to evaluate for long-term stability.

As the popularity of digital currencies like Bitcoin grows, it’s crucial for investors to weigh the potential for high returns against the risks. When evaluating Real Estate vs Crypto: Which is the Best Investment, real estate still offers more stability and predictability in a volatile market.

Key Differences Between Real Estate and Cryptocurrency

When comparing real estate and cryptocurrency as investment choices, several key differences highlight their unique nature and appeal:

Tangibility: Real estate is a physical asset—like land or property—that you can see, use, and manage. In contrast, cryptocurrency is entirely digital, existing only on blockchain networks without any physical form.

Volatility: Real estate tends to appreciate steadily over time, making it a more predictable and stable investment. On the other hand, cryptocurrency is known for extreme price volatility, with values often rising or falling dramatically in short periods.

Accessibility: Investing in real estate usually requires a local presence and hands-on management. Cryptocurrency, however, offers global accessibility, allowing users to trade and transact instantly from anywhere with an internet connection.

Risk Level: Real estate is generally viewed as a low-risk, long-term investment backed by historical performance. Cryptocurrency, while potentially high-reward, involves significant risk due to its speculative nature, regulatory uncertainty, and rapid market shifts.

Understanding these differences can help investors choose wisely when deciding between real estate vs crypto: which is the best investment for their goals and risk appetite.

The Winner: Real Estate

Here’s why we consider real estate as the best investment option for 2025

Leave a Reply